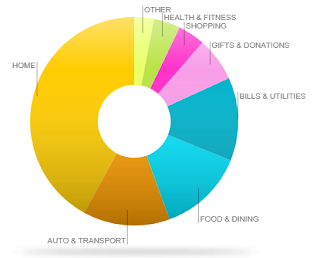

DFG March 2018 Frugalmaster Results

March 2018 Using the Frugalmaster machine (your mind) often results in a happier life and a fuller wallet. You use this machine every time you decide to delay gratification of stuff and instead focus your energies on what makes you happier. Category Spent FrugalMaster Notes Housing/ Insurance $2,260 Still paying extra $700 in principle Transportation $831 Repair work on the minivan Food $823 Extra week of food shopping. We ate out once and got pizza once. Need to curb that since next month I will be unemployed. Utilities $798 Such a drain (get it?) Gifts/Charity $419 Candy bar sale for our church ended. We sold a bit and bought some for ourselves. I didn't deposit the cash in time so we will see a dip in this category next month. Home Maintenance/ Supplies