August 2016 Dividends

The snowball is

rolling once again. After a few months

of little dividends I (not really but companies I own part of) pulled in a

decent month of $268.33. Most of it

coming from my redesigned

dividend portfolio from a few months back.

With four months left in 2016 we will see if I am able to come out ahead

of last year. This year is about $700

behind were I was last year. I have been

holding on to my cash so far this year as I might be making a real estate

purchase. If that doesn't happen I will

at least get it invested in my wife's and my IRA's. Whatever cash is left over will go into the

old taxable account.

If my AGI is too high

this year I may not be able to take any deductions

from IRA contributions. If that is

the case I would almost be better off putting it into my ROTH IRA. We will see closer to tax time. What are your

thoughts on it? If I go above $118k in

AGI where is the best tax advantage?

Company

|

Held In

|

Dividend

(Qtr)

|

Amount Received

|

Shares of Life Purchased

|

August Notes

|

Verizon (VZ)

|

Taxable

|

$0.578

|

$1.13

|

0.0207

|

2.21% dividend

increase

|

Procter &

Gamble Co. (PG)

|

Taxable

|

$0.670

|

$0.67

|

0.0077

|

|

Alliance Holdings

GP LP (AHGP)

|

Taxable

|

$0.550

|

$0.55

|

||

Caterpillar Inc

(CAT)

|

Taxable

|

$0.770

|

$0.77

|

0.0091

|

|

Helmerich and

Payne Inc (HP)

|

Taxable

|

$0.700

|

$0.70

|

||

Intel Corp (INTC)

|

Taxable

|

$0.260

|

$0.78

|

0.0215

|

|

Murphy Oil Corp

(MUR)

|

Taxable

|

$0.250

|

$0.50

|

Cut dividend/time

to sell

|

|

AT&T Inc. (T)

|

IRA

|

$0.480

|

$48.00

|

1.1095

|

|

Verizon (VZ)

|

IRA

|

$0.578

|

$56.50

|

1.0368

|

|

UNIVERSAL CORP VA

(UVV)

|

IRA

|

$0.530

|

$26.50

|

0.4393

|

|

ABBVIE INC SHS

(ABBV)

|

IRA

|

$0.570

|

$28.50

|

0.4251

|

|

Procter &

Gamble Co. (PG)

|

IRA

|

$0.670

|

$33.48

|

0.3849

|

|

BOWL AMERICA

INC CL A (BWLA)

|

IRA

|

$0.170

|

$51.00

|

3.5466

|

|

Caterpillar Inc

(CAT)

|

IRA

|

$0.770

|

$19.25

|

0.2286

|

The new account was

set to reinvest dividends automatically.

I forgot that I have 30 free trades a month so I set it to accept cash

instead. However that didn't get through

their system in time so I have all of these reinvestments this month. I might as well use those trades even if it

is only on a couple of shares (in the right companies).

For the month there

wasn't much news. Verizon (VZ) bumped the dividend

while I was on vacation. Murphy Oil (MUR) cut theirs. Unfortunately that means time to sell. As a dividend growth investor you want to own

companies that increase their dividend every year. Stagnant or decreasing dividends won't keep

up with inflation or support you well into retirement. You want companies with increasing earnings

each year (and thus increasing dividends.)

The energy sector has been hit hard this year so it was no surprise.

Only those companies with tons of cash will be able to survive this energy

storm.

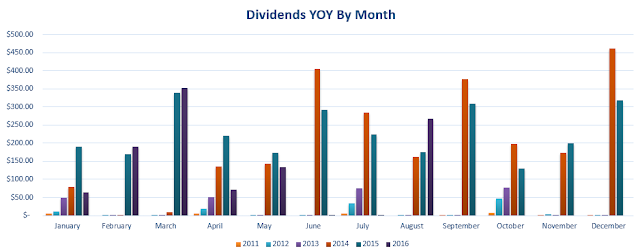

YOY (year over year)

dividends received was a 53% increase which is always good to see. I would like to say that was from capital

injection. Maybe some of it was but most

comes from the new portfolio.

I hope you had a good

month and the dividends rolled in for you.

Thanks for reading!

Dividend Family Guy

Wow DFG, that's a huge increase - very impressive. I love all the YOY graphs as it can show what great progress you're making - keep it up :)

ReplyDeleteWe got $0 dividends in August, oh well. Next month will be better.

Tristan

Hi Tristan,

DeleteYep the graph is decent. I may change it to total dividends for the year per month as that might be a little smoother and easier to see progress. My current graph is choppy. Don't worry about 0 some months.

Later,

DFG

You brought in a very respectable number for the month of August. Even though those cuts hurt, they just happen. It's all part of being a dividend growth investor. At least your portfolio looks very well diversified with a lot of solid payers to pick up the dividend slack. Thanks for sharing.

ReplyDeleteHey Keith.

DeleteIt does hurt but like you said that is why we diversify so we don't loose all of our income in one cut. Cuts happen, just have to plan for it.

Cheers,

DFG

Very nice year over year increase, congratulations~! You'll start to see the new portfolio work for you in the next few months and years -- keep up the good work!

ReplyDeleteThanks Ferdi,

DeleteI always receive lots of encouragement from the community. You guys keep me at it.

DFG

Hi DFG,

ReplyDeleteIt's great to see the snowball rolling again - especially since August is a fairly quiet month too!

If you can't deduct your IRA contributions then I'd think it's better to pay into a Roth than a T-IRA account (can access money earlier if needed, zero tax to pay on it vs. forced RMD and marginal taxes on capital gains in a T-IRA). Roth contributions also have an income limit but it's quite a bit higher than the IRA limits if you file jointly.

Congrats on a great month!

-DL