Budget Buster in 2016 or not?

|

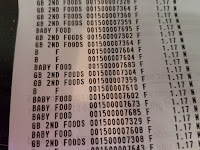

| Hungry baby! |

Did I meet my budget

for 2016? Well the short answer is yes

and no. If I spent only what we needed

to live off of (needs) then I was under budget by about $900 for the year. That is

great that I am able to live within my budget to survive.

Now the harder part to

talk about. My family and I continue to

fall prey to the consumerist beast.

While not as bad as other Americans it still caused us to go over our GFSM budget

by $1,067. While that is not a huge sum when you look at

it for the year I had to give it a red cell in my spreadsheet.

Where did I

overspend? About half of that went to

pay for my daughters candy bar sale money.

Instead of saving the cash I got, I blew it on things like eating out

and miscellaneous junk. Then in the end

I had to write the check to pay for it all.

My lesson learned from that is to track cash expenditures so I can see

the effects on my budget as the month proceeds.

The remainder of the overspending was just as simple as buying something

we probably didn't need each month and going over my $300 budget. Lesson learned there is to stop buying stuff

you don't need!

So how do I handle

cash that never sees a bank? I never

really could figure out a way in Quicken besides setting up a cash

account. Seemed like a lot of work to do

and I have been getting tired of always punching in all my receipts and

categorizing them. By tired I mean I

would rather spend my time reading DGI articles and researching investments.

I have always wanted

to try Mint. I used to work for Intuit and they put a good

deal of effort into usability of their software. So I have high hopes for a good web and

mobile experience. While Quicken was

owned by them they sold it off in March of last year. So I have setup my 2017 budget in Mint and

will give you all an update on it later.

Now onto

the 2017 budget

I am switching it up

this year and looking at it from the "pay yourself first" angle. To do that I have to roughly save 35% of my

income. The remaining 65% makes up my

budget.

To accomplish the

savings goal and other

goals, I have made the following budget adjustments:

- Pay an extra $700 in principal on my mortgage every month to have it paid off in 10 years.

- Keep food costs the same even though prices continue to rise ($700/mo)

- Stay healthy to maximize HSA contributions that can be invested ($563/mo)

- Shrank my miscellaneous need category by $250/mo. I guess I need to find cheaper toilet paper :-)

Those were the

positive budget adjustments. I still had

to take into account the ever rising costs of utilities and picking up my son's

auto insurance until he gets a job this summer.

Luckily my work picks up my phone bill so I only have to pay for my

family's phones.

Our vacation budget

has also been cut in half, while the Christmas budget remains unchanged. Last year we took several vacations but this

year I only plan on doing one big one.

The remainder of my vacation time will be staycations at home doing

local free things and fixing up the house.

Last year, with the baby, I put no effort into the house and it is in

need of some TLC.

Like all things

budgets change. I am sure I will

continue to tweak it over the coming months.

The nice thing is in Mint it remembers the budget for each month so you

can tweak it as often as you like (and historical reporting remains accurate).

Wish me luck!

Dividend Family Guy

Nice toilet paper is one of those luxuries in life. You can find some really cheap ones but it can feel like sandpaper. Finding a happy medium sounds like what you are after.

ReplyDeleteWe settled on Scott's 1 ply. Affordable but not bad on my butt.

DeleteCheers,

DFG

I like the angle of paying the mortgage down. I did that exclusively before starting to invest. I liked the guaranteed return.

ReplyDeleteMy estimated savings is $74,192. So you are correct it is an decent return!

DeleteLooks pretty good to me DFG. Considering the savings you've said in the above comment, I think if you achieve that you're doing really well. Whatever you achieve will be good, just aiming for it will get you a long way there.

ReplyDeleteTristan

Thanks Tristan.

Delete