June 2017 FrugalMaster Results

|

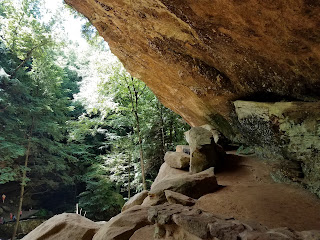

| The Caves at Hocking Hills |

Summer is here and I

tend to spend as much time outside as possible.

To get more exercise I have taken it upon myself to wake up early every

morning and do yard work (some call it gardening). I do this for about an hour before coming in

to get ready for work. It is very

relaxing being outside when all is quiet (especially since the rest of the

family is still sleeping.)

The outside work also

tends to bump up my home costs during the summer. However that is budgeted for the year. I do not look at it as money lost because it

improves the curb appeal of the house for when we sell. I was reading some article that explained

that your house will sell faster as the outside is the first thing potential

buyers see. This makes sense as it is a

reflection of how well you take care of the house in general.

This month there was a

large jump in health related expenses.

This was due to me being diagnosed with scoliosis. I guess I have always had it and my back

problems were getting worse. I am seeing

a chiropractor and the results are great.

Since I am writing this in July most of my pain is gone. Now he is just straightening me out and

helping me strengthen my core.

Unfortunately since I have an HSA all of that has been out of pocket

since my deductible is very high.

|

| June Expenses |

Shopping looks a bit

high in the pie graph doesn't it? We

invested in some high quality hiking boots for our trip to Hocking Hills State

Park in Ohio. This was an awesome vacation

and we hiked every day. Some of the

other shopping related expenses were kids clothing shopping for the upcoming

school year.

Overall it was another

good month. Income was way up (another

article on that forth coming). My

spending was up as well but still came in at 97%

of my normal monthly income. That means I incurred no additional debt nor

did I have to dip into any savings.

Totaling it up my frugal exercises let me save 51% of my total income for

the month. About 40% of the savings were invested and then rest swept into my

savings accounts.

I hope your June was

great and I look forward to hearing about your June as well.

Happy investing,

Dividend Family Guy

Fantastic month for you. Keep up the good work!

ReplyDeleteThanks BHL!

DeleteAfter ignoring my expenses for a while, I started to keep track of them while I was travelling during a year. I'm now back for about 2 weeks at home and kept this habit. I hope I'll be able to control my expenses and make them smaller each month.

ReplyDeleteCheers,

Mike

Good luck Mike/DivGuy. I switched to Mint this year to keep tracking everything as simple as possible. I still use some spreadsheets though for overall stuff.

ReplyDeleteHi DFG,

ReplyDeleteCongrats on tracking your spending and managing to save over half your salary!

Glad to hear that your health problems are being addressed. I know what you mean about the high deductible so now I'm slowly trying to save up enough to cover the maximum out of pocket expenses in my savings account. I'm trying to avoid touching my HSA balance as it's mostly in the stock market.

Best wishes,

-DL

Yep rule of thumb is have enough cash to not have to dip into the HSA. The majority of mine is invested as well.

DeleteCheers,

DFG