June 2017 Dividends

Ah the feeling of

sweet hard cold cash rolling into my accounts.

It was my best month so far this year.

$450.41 total which included $423.25 into my IRA

and another $27.16 into my regular (taxable) account. I don't include my regular account in my

income as that is always reinvested into more companies which keeps the

snowball growing.

Overall there were 8

increases. Some were double digit growth

and some < 1%. Below is the list and

any notes I made.

|

Company

|

Symbol

|

Held In

|

Dividend

|

Amount Received

|

June Notes

|

|

Helmerich

Payne Inc

|

HP

|

Taxable

|

$

0.700

|

$ 0.70

|

|

|

Intel

Corp

|

INTC

|

Taxable

|

$

0.273

|

$ 0.82

|

5% increase

|

|

Wal-mart

Stores Inc

|

WMT

|

Taxable

|

$

0.510

|

$ 7.65

|

|

|

Archer

Daniels Midland

|

ADM

|

Taxable

|

$

0.320

|

$ 4.16

|

|

|

Exxon Mobil Corp

|

XOM

|

Taxable

|

$

0.770

|

$ 1.54

|

2.66% increase

|

|

Chevron Corp

|

CVX

|

Taxable

|

$

1.080

|

$ 2.16

|

|

|

Intl Business

Machines Corp

|

IBM

|

Taxable

|

$

1.500

|

$ 7.50

|

7.14% increase

|

|

Nu Skin Enterprs A

|

NUS

|

Taxable

|

$

0.360

|

$ 0.36

|

|

|

Old Repub Intl

Corp

|

ORI

|

Taxable

|

$

0.190

|

$ 0.76

|

|

|

Mcdonalds Corp

|

MCD

|

Taxable

|

$

0.940

|

$ 0.94

|

|

|

Price T Rowe Group

Inc

|

TROW

|

Taxable

|

$

0.570

|

$ 0.57

|

|

|

Unilever Plc

|

UL

|

IRA

|

$

0.383

|

$ 2.30

|

11.3% increase for

USA'ers

|

|

Archer Daniels

Midld

|

ADM

|

IRA

|

$

0.320

|

$ 32.00

|

|

|

Microsoft Corp

|

MSFT

|

IRA

|

$

0.390

|

$ 9.75

|

|

|

Exxon Mobil Corp

|

XOM

|

IRA

|

$

0.770

|

$ 85.47

|

|

|

Emerson Elec Co

|

EMR

|

IRA

|

$

0.480

|

$ 24.00

|

|

|

Target Corp

|

TGT

|

IRA

|

$

0.600

|

$ 30.00

|

|

|

Intl Business

Machines Corp

|

IBM

|

IRA

|

$

1.500

|

$ 6.00

|

|

|

Johnson And

Johnson

|

JNJ

|

IRA

|

$

0.840

|

$ 42.00

|

5% increase

|

|

Old Repub Intl

Corp

|

ORI

|

IRA

|

$

0.190

|

$ 74.67

|

|

|

Mcdonalds Corp

|

MCD

|

IRA

|

$

0.940

|

$ 23.50

|

|

|

V F Corporation

|

VFC

|

IRA

|

$

0.420

|

$ 4.62

|

|

|

Qualcomm Inc

|

QCOM

|

IRA

|

$

0.570

|

$ 10.26

|

7.5% increase

|

|

Flowers Foods Inc

|

FLO

|

IRA

|

$

0.170

|

$ 5.44

|

6.25% increase

|

|

Price T Rowe Group

Inc

|

TROW

|

IRA

|

$

0.570

|

$ 8.55

|

|

|

Brinker Intl Inc

|

EAT

|

IRA

|

$

0.340

|

$ 7.48

|

|

|

Mercury Genl Corp

|

MCY

|

IRA

|

$

0.623

|

$ 31.13

|

|

|

Unvsl Helth Rlty I

T Sbi Reit

|

UHT

|

IRA

|

$

0.660

|

$ 16.50

|

.76% increase

|

|

Wisdomtree Japan

Hedged Reit

|

DXJR

|

IRA

|

$

0.010

|

$ 3.16

|

|

|

Intl Business

Machines Corp

|

IBM

|

ROTH

|

$

1.500

|

$ 6.00

|

|

|

V F Corporation

|

VFC

|

ROTH

|

$

0.420

|

$ 0.42

|

|

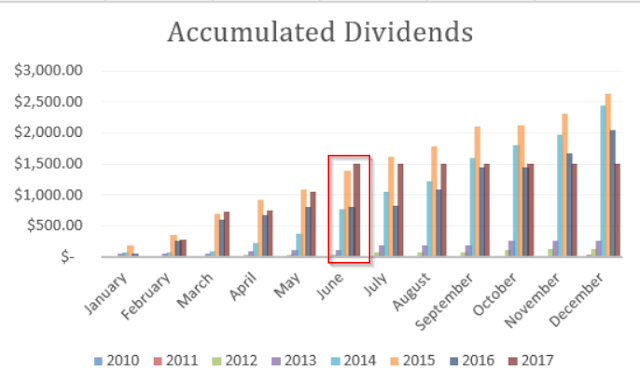

Compared to last year

it has been a welcome jump back up and above 2015. Last year the portfolio was getting

restructured so there were a few months of little to no dividends from my IRA.

Hopefully there will

be another jump soon when I rollover my previous

job into my IRA. It is always good

to get away from high expense and poorly performing funds to companies of your

own choosing. With the benefit of no

expenses and the dividend growth machine I can't wait to see how they perform

compared to the funds they came from.

I am off on vacation

next week to Mackinac Island to

enjoy the Great Lakes and some of the clearest waters around.

Happy dividend

collecting,

Dividend Family Guy

Nice results for the month of June. A lot of common names paying us both. I still want ORI in my portfolio one of these days. Keep up the good work and enjoy your trip!

ReplyDeleteThanks Keith, will do on the enjoying part!

ReplyDeleteDFG